Electric Contracts

Toll Free Call

1-866-646-7322

Empower Your Business

Business Electric Contracts To Sustain Your Financial Success

Energy can represent one of the largest parts of your operational expense. Taking the time to choose the right electric contract is an important step in improving your bottom line.

Pricing options vary according to a company’s size, energy load profile, and risk tolerance.

Choosing the best energy contract for your business should involve more than just selecting the lowest rate. Months down the road, changing rates and hidden terms often make that good rate bad, leaving businesses chained to costly contracts. Beyond that, your energy strategy should examine how much budget certainty you need, your energy efficiency goals, and the way business operations determine your energy consumption. If you’re not sure about any of that, it’s okay. We’re glad to walk you through it.

Balancing Risk, Budget, and Business Goals

Electric Contract Options

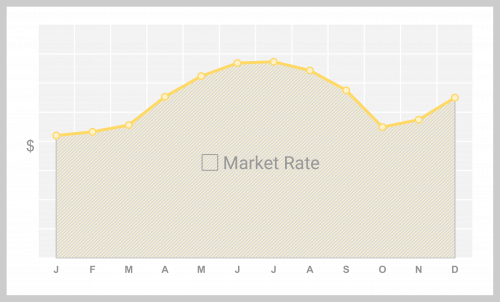

Index

The index price contract allows you to monitor market conditions and remain on a market rate if you believe prices will stay flat or fall. It also gives you the ability to convert to a fixed price when the time is right.

- Ideal if you are willing to bear the risk associated with market price volatility in order to try and drive out additional costs (premiums).

- Caution – due to varying market based electric prices, it is difficult to accurately forecast energy expense budgets and you assume the risk associated with price and usage volatility.

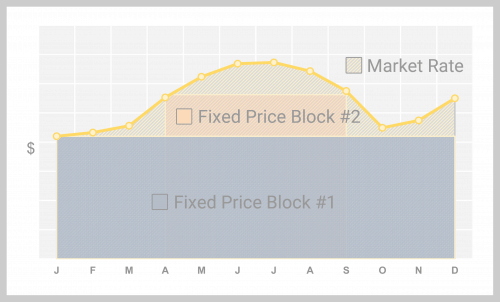

Block and Index

A Block and Index contract allows you to secure their non-energy costs and layer in fixed commodity purchases. This spreads price risk over multiple volume-based transactions (blocks) while allowing the rest of the load to remain on market-based rates.

- Ideal if you want to take an active role in managing your electric buys and have consistent usage patterns. This type of contract allows you to optimize purchasing based on how/when you use power or in response to market lows.

- Caution – under a Block and Index contract, you will always have some portion of your load exposed to market index rates.

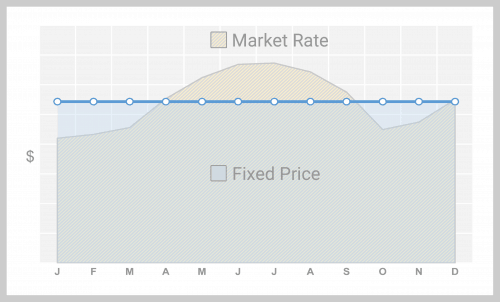

Fixed

Fixed price contracts allow you to lock in a set price per KWh for the term of the agreement while minimizing risk without concern of a volume commitment. Keep in mind market prices may decline after you lock in your price.

- Ideal if you want budget certainty and have low risk tolerance.

- Caution – price and budget certainty comes at a cost. Suppliers add a risk premium for the volume and price risk they assume.

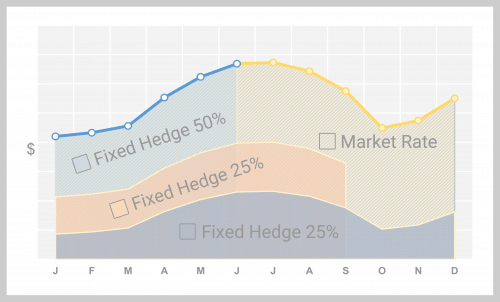

Load Following

A Load Following contract allows you to secure non-energy costs and layer fixed energy purchases, spreading price risk over multiple percentage-based buys.

- Ideal if you want purchase flexibility with budget certainty. By securing up to 100% of your load you can make buys based on how you use power or in response to market opportunities.

- Caution – You should be willing to take an active role in managing your program – this doesn’t allow you to “set it and forget it.”