For natural gas report week July 29, 2021, the EIA reported a net increase in storage of 36 Bcf. The injection was at the low end of forecasts which ranged from 36 Bcf to 52 Bcf and averaged 40 Bcf. In comparison, last year for the same week there was an injection of 27 Bcf and the five-year average is an injection of 28 Bcf.

Working gas in storage was 2,714 Bcf as of Friday, July 23, 2021 per EIA estimates. Inventory was 523 Bcf (-16.2%) less than last year for the same week and 168 Bcf (-5.8%) below the five-year average of 2,882 Bcf.

Natural Gas Market Recap

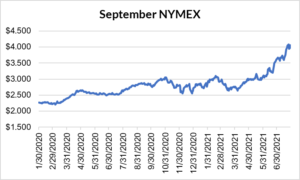

September NYMEX

September NYMEX: September settled Thursday at $4.059/Dth up 9.2 cents from Wednesday’s close at $3.967/Dth.

August NYMEX: August moved off the board Wednesday, July 28th, settling the month at $4.044/Dth.

12 Month Strip

Settled Thursday at $3.758/Dth, up 2.9 cents from the prior week.

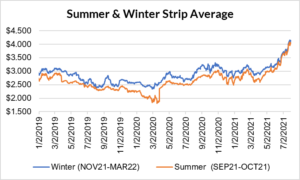

Seasonal Strips

The summer strip (SEP21-OCT21) settled Thursday at $4.060/Dth, up 7.3 cents from the week prior. The winter strip (NOV21-MAR22) settled Thursday at $4.144/Dth, up 9.6 cents from the week prior.

Natural Gas Report – July 29, 2021

Fundamentals

Overall supply averaged 98.3 Bcf/d last week as production fell slightly by 0.4%, week over week. Meanwhile, imports from Canada grew by 11.1%.

Total demand rose by 3.6% from the prior report week, averaging 92.6 Bcf/d. Residential-commercial and power generation demand increased by 5.7% and 5.8%, respectively. Meanwhile, LNG pipeline receipts averaged 10.7 Bcf/d, growing slightly week over week.

Up to this point in injection season, the average rate of injections is 13% lower than the five-year average. If the rate of injections matched the five-year average of 8.4 Bcf/d, inventory would be 3,551 Bcf at the close of refill season. That’s 168 Bcf lower than the five-year average of 3,719 Bcf.

Natural Gas Prices

Spot prices generally increased week over week, remaining driven by weather conditions. Where temperatures were mild, price movement was subdued. Elsewhere, summer heat increased use in power generation to meet cooling demand.

Despite an injection that exceeded both last year and the five-year average, the addition to storage still fell at the low end of analysts’ expectations. With early predictions for strong storage reports slated for the last two weeks of July, the disparity resulted in bullish market sentiment. August settled above the $4 mark which hasn’t happened this time of year since 2014.

Above-average temperatures led to increased cooling demand. With wind generation down last week, there was an even greater reliance on natural gas used in power generation. This, along with continued high LNG demand, led to the disappointing injection. Even with another week of hot temperatures behind us and concerns for another anemic injection anticipated for next week, it’s unclear whether or not the market will continue to push much above the $4 mark.

DEC21, settled at $4.217/Dth, up 9.4 cents

JAN22, settled at $4.276/Dth, up 9.5 cents

FEB22, settled at $4.190/Dth, up 9.8 cents

MAR22, settled at $3.919/Dth up 10.6 cents

APR22, settled at $3.292/Dth up 10.8 cents

Strips

24 Month, settled at $3.432/Dth up 4.2 cents

36 Month, settled at $3.219/Dth up 3.5 cents

Energy Infrastructure

The Senate is set to advance a $550 billion bipartisan infrastructure bill that includes provisions for roads and bridges, public transportation, electric vehicle charging infrastructure, clean water initiatives, broadband improvements, and energy-related updates. The bill will require 60 votes before it will be passed to the House. Although the bill’s language is still incomplete, some key energy allocations include money for:

- Cleanup of abandoned oil and gas wells.

- Expansion of power transmission networks.

- Transitioning from fossil fuels to clean energy.

- Investment in existing and emerging generation sources.

- Cybersecurity.

- Keystone XL pipeline job loss study.

Read more about the infrastructure package here.

Do you have the best natural gas contract for your business?

We can help you evaluate your current contract and explore your natural gas buying options. Call us at 866-646-7322 for a no-cost, no-obligation analysis today.